| versión para imprimir - envía este articulo por e-mail |

Economics lecturers accused of clinging to pre-crash fallacies

Por The Guardian -

Thursday, Nov. 14, 2013 at 10:19 PM

Academic says courses changed little since 2008 and students taught 'theories now known to be untrue'

karl-marx--008.jpg, image/jpeg, 460x276

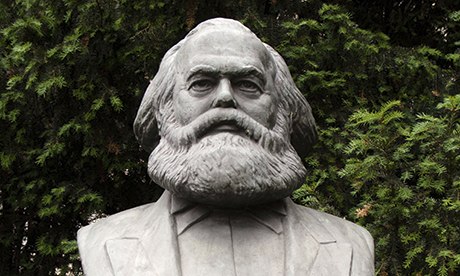

Economics departments have been accused of ignoring critics of the free market such as Karl Marx. Photograph: Alamy

Phillip Inman, economics correspondent

The Guardian, Sunday 10 November 2013 22.28 GMT

Economics teaching at Britain's universities has come under fire from a leading academic who accused lecturers of presenting "things that are known to be untrue" to preserve theories that claim to show how the economy works.

The Treasury is hosting a conference in London on Monday to discuss the crisis in economics teaching, which critics say has remained largely unchanged since the 2008 financial crash despite the failure of many in the profession to spot the looming credit crunch and worst recession for 100 years.

Michael Joffe, professor of economics at Imperial College, London, said he was disturbed by the way economics textbooks continued to discuss concepts and models as facts when they were debunked decades ago.

He said: "What if economics was based more on empirical studies and empirical evidence? There are lots of studies and economists are often very good at finding the evidence for how things work, but it does not feed into or challenge what's in the textbooks.

"I asked a textbook author recently why a theory that is known to be wrong is still appearing in his book he said to me that his publisher would expect it to be there."

Joffe, a former biologist, called for more evidence in economic teaching in the October edition of the Royal Economic Society newsletter. He said many reformers had called for economics courses to embrace the teachings of Marx and Keynes to undermine the dominance of neoclassical free-market theories, but the aim should be to provide students with analysis based on the way the world works, not the way theories argue it ought to work.

"There is a lot that is taught on economics courses that bears little relation to the way things work in the real world," he said.

The Treasury-hosted conference will debate the state of economics teaching, with leading figures from the profession invited to speak, including Bank of England director Andy Haldane. Sponsored by the Institute for New Economic Thinking (INET), it aims to highlight reforms to address the shortcomings of the core economics curriculum.

Headed by economics professor Eric Beinhocker of Oxford University, the INET has grown into a large international lobby group with the aim of reforming mainstream economic teaching in the world's leading colleges.

The conference comes only a fortnight after Manchester University economics students criticised orthodox free-market teaching on their course, arguing that alternative ways of thinking have been pushed to the margins.

Members of the Post-Crash Economics Society said their course was dominated by models and equations that trained undergraduates for City jobs without a broader understanding of the way economies and businesses work.

Joe Earle, a spokesman for the society and a final-year undergraduate, said academic departments were ignoring the crisis in the profession and that, by neglecting global developments and critics of the free market such as Keynes and Marx, the study of economics was "in danger of losing its broader relevance".

The profession has been criticised for its adherence to models of a free market that claim to show demand and supply continually rebalancing over relatively short periods of time in contrast to the decade-long mismatches that came ahead of the banking crash in key markets such as housing and exotic derivatives, where asset bubbles ballooned.

Joffe said university economics department were continuing to teach concepts that had been disproved. In one example he said the idea that companies suffer "dis-economies of scale" when they increase production beyond certain capacity was true in only a small number of firms.

The U-shaped curve shows that unit costs are high when production begins and become cheaper as economies of scale allow a company to spread costs over more units. Units become more expensive to produce after a factory reaches capacity.

Joffe said: "We ought to stop teaching the U shape as the typical relationship between costs and scale, for the simple reason that it is false."

This article was amended on 10 November 2013. The original said that Wendy Carlin heads the Institute for New Economic Thinking (INET) when she chairs the INET's CORE curriculum group. This has been corrected

www.theguardian.com/education/2013/nov/10/economics-lecturers-accused-univers...